CA Programme Course Details

The Institute of Chartered Accountants of India (ICAI) is the premier professional body which has been set up by an Act of the Parliament viz. Chartered Accountants Act, 1949 for regulating the Chartered Accountancy profession in India. The profession has seen radical changes from its introduction.

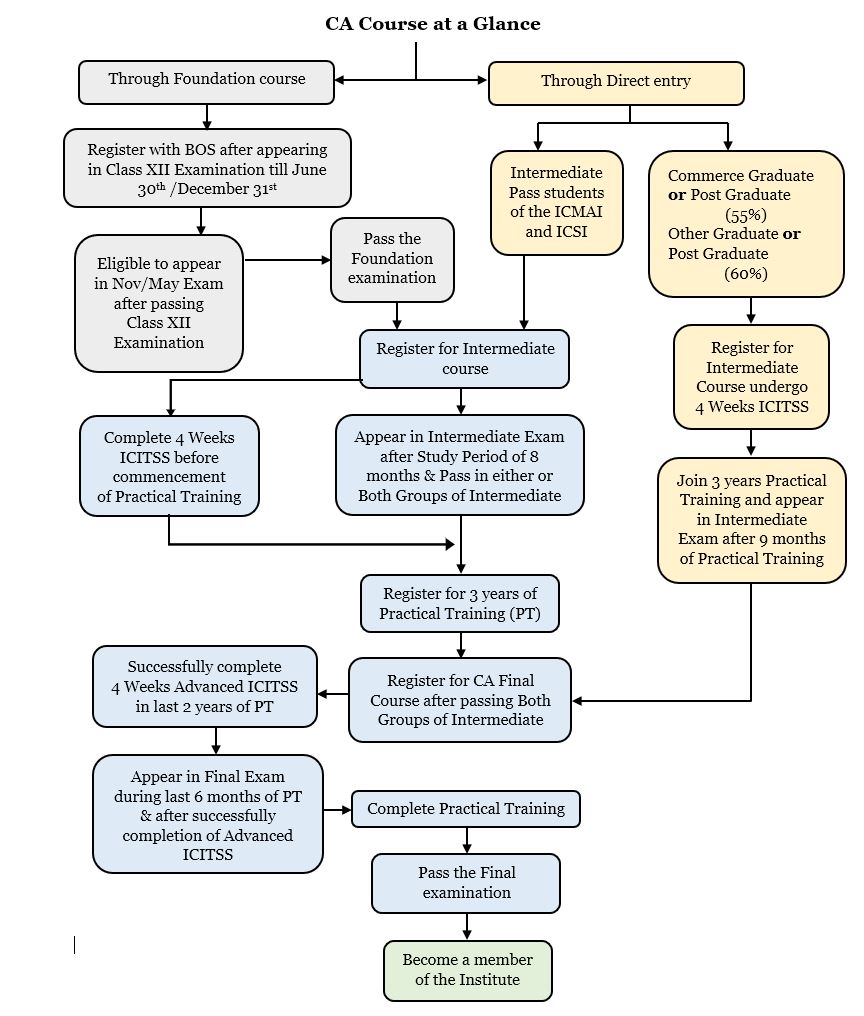

Foundation Route –

- Registration for Foundation Course after appearing in Class 12th Examination. (You can refer the “Level I – CA Foundation tab below to find out the process to register)

- Complete four months Study Period. Register till 30th June/ 31st December for being eligible to appear in November/ May Foundation Course Examination.

- Write the Foundation Examination after passing in the 12th Examination

- After Qualifying the Foundation examination, register for the Intermediate Course.

- Write the Intermediate Examination after completing 8 months of study course as on first day of the month in which the examination is to be held.

- Complete Four weeks of Integrated Course on Information Technology and Soft skills (ICITSS) consisting of Courses on Information Technology and Orientation Course at any time after registering for the Intermediate course but before commencement of their Articleship.

- Complete three years of Articleship training after passing either of the Group or Both Groups of Intermediate Course.

- After completing both the groups of the Intermediate level, register for Final Course.

- Complete Four weeks of Advanced Integrated Course on Information Technology and Soft skills (AICITSS) consisting of Courses on Advanced Information Technology and Management Communication Skills during the last two years of practical training but before appearing in the Final Examination.

- Write the Final Examination on completion of the practical training or while serving last 6 months of articled training and after successful completion of AICITSS.

- Complete Articleship training of 3 years.

- Pass the Final Examination.

- Register yourself as a member of the ICAI and be designated as “Chartered Accountant”

Direct Entry Scheme –

I. Commerce Graduates/Post-Graduates (55%) or Other Graduates/Post-Graduates (60%):

- Register with the Institute for the Intermediate Course. (You can refer the “Level II – CA Intermediate tab below to find out the process to register)

- Complete Four weeks of Integrated Course on Information Technology and Soft skills (ICITSS) consisting of Courses on Information Technology and Orientation Course before commencement of their Articleship.

- Register for Practical Training of three years.

- Write the Intermediate Examination on completion of 9 months of Practical Training.

- Appear and pass both groups of Intermediate Examination.

- Register for Final Course.

- Complete Four weeks of Advanced Integrated Course on Information Technology and Soft skills (AICITSS) consisting of Courses on Advanced Information Technology and Management Communication Skills during the last two years of practical training but before appearing in the Final Examination.

- Write the Final Examination on completion of the practical training or while serving last 6 months of articled training and after successful completion of AICITSS.

- Complete articled training of 3 years.

- Pass Final Examination.

- Register yourself as a member of the ICAI and be designated as “Chartered Accountant”

II. Candidates who have passed Intermediate level examination of Institute of Company Secretaries of India (ICSI) or Institute of Cost Accountants of India (ICMAI):

- Register with the Institute for the Intermediate Course. (You can refer the “Level II – CA Intermediate tab below to find out the process to register)

- Complete Four weeks of Integrated Course on Information Technology and Soft skills (ICITSS) consisting of Courses on Information Technology and Orientation Course at any time after registering for the Intermediate course but before commencement of their Articleship.

- Write the Intermediate Examination on completion of 8 months of study course.

- Complete three years of Articleship training after passing either of the Group or Both Groups of Intermediate Course and after successfully undergoing ICITSS.

- After completing both the groups of the Intermediate level, register for Final Course

- Complete Four weeks of Advanced Integrated Course on Information Technology and Soft skills (AICITSS) consisting of Courses on Advanced Information Technology and Management Communication Skills during the last two years of practical training but before appearing in the Final Examination.

- Write the Final Examination on completion of the practical training or while serving last 6 months of articled training and after successful completion of AICITSS.

- Complete articled training of 3 years.

- Pass Final Examination.

- Register yourself as a member of the ICAI and be designated as “Chartered Accountant”.

Three Levels in the CA Programme

Eligibility Criteria for CA Foundation registration

- Candidates must have appeared for Senior Secondary (10+2) examination from a recognized board mentioned in Annexure A. (Note 1) AND

- Candidate must registered on or before 1st January/1st July for the examination to be held in the month of May/June/December respectively as decided by the Council.

Note 1: For you to become eligible to appear for the CA Foundation examination, you are mandatorily required to clear the Senior Secondary (10+2) examination.

Documents Required for Registration

In the CA Registration form, the candidates should keep the following list of scanned documents ready:

- Attested copy of admit card/ marksheet of Class 12th issued by the respective Board.

- One recent color photograph (affixed on the printout of the online successful registration form)

- Attested copy of proof of Nationality, if student is a foreigner.

- Attested copy of proof of special category certificate i.e., SC/ST, OBC, Differently abled.

- Attested copy of the 10th Marksheet/ admit card of 10th class indicating the name & date of birth.

- The duly signed printout of online successful registration form in hard copy.

Registration Procedure

If you are looking to register for CA Foundation, you can do it online on the ICAI’s website

- Click on this link – https://eservices.icai.org/

- Select the option “New students enrolling to SSP for the first time“

- Click on the link against “Entry level forms (Foundation and Intermediate (Direct Entry))”

- You will be redirected to a login page. Select the option “New Students who want to register for CA for the first time“.

- Enter the details on the page and generate an OTP. Please note that the Salutation, Name, Gender, Date of Birth should be as per your 10/12 certificate. No changes will be allowed after you submit this section of information.

- OTP for international numbers will be sent to your email ID. Enter the OTP in the given box and click on the “Submit” button

- On submitting the OTP, you will receive a message that you need to log in with the registered email id and password.

- Enter your User ID and Password in the given field on the login page.

- Click on the “Login” button to submit the details

- On successfully logging in, click on “Student cycle” on the left side and click on “Apply for Foundation“.

- Apart from the pre-filled data, you will have to provide other relevant information needed for your Registration process. Follow the process mentioned.

- You are required to upload the scanned copies of the original documents of 10th and 12th qualification. (In case of a provisional registration, you would need to upload the scanned copy of your 12th admit card.) Please note that the file size restriction for each scanned copy you upload is 1 MB only, so ensure your files meet this requirement.

- You will need to upload your photo and a photo of your signature in the Registration form. The maximum size of the image is width: 21 centimeters and length: 27 centimeters. If the given image conditions are not satisfied, then your application will be rejected.

- You would need to pay the requisite amount for the registration to the Foundation Course online.

- On successful payment of the fee, the system will automatically generate the Form along with a successful transaction message.

Cut Off date for Registration

- 30th June for appearing in November examination of the same year

- 31st December for appearing in May examination of the next year

Course Curriculum

- Paper 1 – Principles and Practice of Accounting (100 marks)

- Paper 2 – Business Laws and Business correspondence and Reporting

Section A: Business Laws (60 marks)

Section B: Business correspondence and Reporting (40 marks)

- Paper 3 – Business Mathematics, Logical reasoning and Statistics

Section A: Business Mathematics (40 marks)

Section B: Logical reasoning (20 marks)

Section C: Statistics (40 marks)

- Paper 4 – Business Economics and Business & Commercial Knowledge

Part I – Business Economics (60 marks)

Part II – Business & Commercial Knowledge (40 marks)

Mode of examination – The Paper 1 & 2 are subjective while the Paper 3 & 4 are objective |

Eligibility Criteria

You can register for CA Intermediate only under two circumstances:

- If you have qualified CA Foundation or

- If you are through Direct Entry scheme i.e., you are a Graduates/Post-Graduates (with minimum 55% marks) or Other Graduates/Post-Graduates (with minimum 60% marks) or you are an Intermediate level passed candidates of Institute of Company Secretaries of India or Institute of Cost Accountants of India.

Documents Required for Registration

Keep the following documents in hand before you proceed for registering for CA Intermediate:

- For Foundation Route students –

- Self attested copy of your 12th mark sheet

- Self attested copy of your 10th mark sheet

- Self attested copy of Foundation mark-sheet

- Recent photograph of yourself

- Scanned photo of your signature

- For Direct Entry Route students – You have to submit an attested copy of the Graduation/ Post Graduation mark statement/mark sheet of Intermediate level examination of the Institute of Company Secretaries of India (ICSI) or the Institute of Cost Accountants of India (ICMAI).

- One recent color photograph (affixed on the printout of the online successful registration form)

- Attested copy of proof of Nationality, if student is foreigner.

- Attested copy of proof of special category certificate, i.e., SC/ST, OBC, Differently abled.

Registration Procedure

You can register for CA Intermediate on the ICAI’s website –

If you a CA Foundation student, follow the following steps:

- You can login into your SSP portal. Click here to reach there – SSP Portal

- The click on the “click here” option to access your SSP portal.

- Click on “Student cycle” on the left side.

- At the top of the page you will find you options. One would be for direct entry scheme and the second would be for Foundation students, you have choose the option for Foundation students.

- Fill the necessary details requested and follow the steps.

- You have to upload the scanned copies of your 10th and 12th mark sheets. (This has to be self-attested by you)

- You have to also upload a recent photograph of yourself. You are required to also upload the photo of your signature. The format of the images should be in either JPEG or JPG format and the file size should not be more than 100 kb.

- After you have filed all the necessary details and uploaded all the required documents, you have to proceed to pay your fees.

- After payment of fees you will be registered for CA Intermediate.

If you are a Direct entry scheme student, follow the following steps:

- Go to the Initial information web-page by click here.

- Provide the necessary details. Please note that your Salutation, Name, Gender and Date of Birth should be as per your 10th/12th certificates. No changes will be allowed after you submit this section of information.

- Click on generate OTP. You will receive a OTP on your mobile number and email ID. If you are an international student, you will get your OTP in your email ID. Verify and submit the OTP.

- After submitting the OTP, you will receive a login credentials.

- Enter those login credentials in this link. Click here

- After you login, click on “Student cycle” on the left side.

- Click on the option “Apply for Direct Entry for New applicants“.

- You will have a pre-filled data already there. You will be asked additional information too. Fill the necessary information and follow the steps mentioned there.

- You will have to upload your self-attested marks sheet of your 10th examination.

- Then choose your registration mode i.e., whether you are a Graduate/Post Graduate student or cleared Intermediate level examination of the Institute of Company Secretaries of India (ICSI) or the Institute of Cost Accountants of India (ICMAI) or any equivalent of foreign education.

- Based on your selection of registration mode, you have to go to the specific section applicable to you and fill in the details of your marks sheet.

- You have you upload the self-attested marks sheet of your relevant level of education.

- After filling the online form, you are required to pay the requisite fees for your course online through the payment gateway. Check all the data before you proceed for your payment to avoid any inconvenience.

- The system will automatically generate the form after successful payment.

Cut Off date for Registration

- 1st March for appearing in November examination of the same year

- 1st September for appearing in May examination of the next year

Course Curriculum

Group I

Paper 1 – Accounting (100 marks)

Paper 2 – Corporate & Other Laws

Part I: Company Law (60 marks)

Part II: Other Law (40 marks)

Paper 3 – Cost and Management Accounting (100 marks)

Paper 4 – Taxation

Section A: Income-tax Law (60 marks)

Section B: Indirect Taxes (40 marks)

Group II

Paper 5 – Advanced Accounting (100 marks)

Paper 6 – Auditing and Assurance (100 marks)

Paper 7 – Enterprise Information Systems & Strategic Management

Section A: Enterprise Information Systems (50 marks) —–> View video lecture offered by us

Section B: Strategic Management (50 marks)

Paper 8 – Financial Management & Economics for Finance

Section A: Financial Management (60 marks)

Section B: Economics for Finance (40 marks)

The mode of examination will be 100% Descriptive based for all papers except the following papers:

(The above 4 papers would be 30% objective and 70% descriptive) |

Eligibility criteria

The CA Final eligibility criteria are as follows:

- Candidates must have passed CA Intermediate.

- Candidate should have registered with Board of Studies (BOS).

- Candidate must have completed the period of articled training or is service the last 6 months of his practical training as on the first date of the month in which the examinations are to be held.

- Candidates must undergo four weeks of Advanced Integrated Course on Information Technology and Soft Skills (AICITSS) during the last two years of practical training (before the exam)

Documents Required for Registration

- A Recent, passport sized coloured photograph

- Duly attested marks sheet of CA Intermediate.

- Specimen Signature

- Attested certificate for Special Category (SC/ST/OBC/PwD)

- Certificate of Nationality (for foreign students)

Registration procedure

Please follow the following steps to register for CA Final online:

- Go to your SSP Portal. Click here to reach your SSP Portal.

- Enter your User ID and Password.

- After successfully logging in, click on “Click here to access the SSP portal”.

- Click on “Student cycle” on the left side

- Click on “Final”

- You will get a form with some pre-filled data and follow the steps.

- You will need to upload your photo, signature and CA Intermediate both groups passed marks sheet.

- You would need to submit the registration form and make the payment for your CA Final registration.

Course Curriculum

Group I

Paper 1 – Financial Reporting (100 marks)

Paper 2 – Strategic Financial Management (100 marks)

Paper 3 – Advanced Auditing and Professional Ethics (100 marks)

Paper 4 – Corporate and Economic Laws

Part I: Corporate Laws (70 marks)

Part II: Economic Laws (30 marks)

Group II

Paper 5 – Strategic Cost Management and Performance Evaluation (100 marks)

Paper 6 – Elective Paper (One to be chosen from the list of Elective Papers) (100 marks)

6A Risk Management

6B Financial Services & Capital Markets

6C International Taxation

6D Economic Laws

6E Global Financial Reporting Standards

6F Multi-disciplinary Case Study

Paper 7 – Direct Tax Laws & International Taxation

Part I: Direct Tax Laws (70 marks)

Part II: International Taxation (30 marks)

Paper 8 – Indirect Tax Laws

Part I: Goods and Services Tax (75 marks)

Part II: Customs & FTP (25 marks)

The mode of examination will be 100% Descriptive based for all papers except

(The above 4 papers would be 30% objective and 70% descriptive) |